Please note that this is a once-off programme, hence taxpayers are urged to make use of this opportunity not only to update and settle their tax accounts but also to register as tax payers.

Hon. Minister of Finance, Calle Schlettwein - Press Statement 26 January 2017.

The Minister of Finance issued a press statement on the 26 th of January 2017 in which the introduction of an incentive programme was announced. The programme forms part of the Ministry’s tax collection and recovery efforts.

The programme will apply to income tax, Value-added tax, import VAT, employee's tax, stamp duties, non-resident shareholder's tax and withholding tax on royalties. No mention was made of withholding tax on services and withholding tax on interest.

The programme will be available to all taxpayers, including companies, close corporations, businesses and individuals that have outstanding debts on any of the tax accounts mentioned above.

The programme will also cover any person or company that has not registered for a particular tax type that he/she/it was obliged to be registered for in the past.

What does the incentive entail?

All tax debts that exist prior to 31 July 2017 will qualify for the incentive programme. In terms of such tax debts, the full capital amount and interest of 20% on the capital amount need to be paid for the incentive to apply.

The settlement payment needs to be made within the period February 2017 to 31 July 2017. Once the capital amount and the 20% interest are paid, the full penalty and 80% of the interest on the debt will be written off by the Ministry. Only once the full principal tax amount and 20% of interest are paid, will the remaining portion of the interest and penalties be waived.

Penalties and interest payments made prior to 1 February 2017 will not qualify for the programme.

All outstanding returns should be submitted before making any payments and processed for the correct amount of tax to be reflected on the Receiver's system.

How must the payment for arrear taxes be made?

A specific bank account was opened into which arrear tax payments should be made. The account differs from the normal tax payment account. The latter should continue to be used for normal tax payments.

The bank account into which arrear payments should be made is as follows:

| Bank | Bank of Namibia |

| Account name | Receiver of Revenue |

| Branch | code 980-172 |

| Type of account | Current |

| Account no | 165011 |

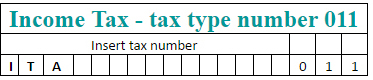

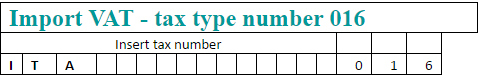

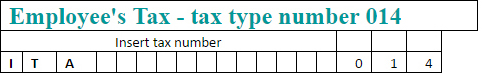

The 19-digit references that should be used when making the payments for the various tax types are the following:

References for stamp duties, withholding tax on royalties and nonresident shareholder's tax payments should be confirmed with Inland Revenue. Payments may be made in instalments over a maximum period of six months, before 31 July 2017.

Application process

Application, on a prescribed form, needs to be made for the incentive to apply. The forms will be available from 1 February 2017 at all Regional Offices and on the website of the Ministry of Finance at www.mof.gov.na

What next?

As a next step we would suggest that full statements of account be obtained from the Ministry of Finance. Furthermore, appropriate actions should be taken to resolve queries and to investigate outstanding balances in preparation for an incentive application.

For assistance please phone us on +264 (0)61 224 893 or submit our contact form.

Hamilton Chartered Accountants provides audit, consulting, financial advisory, risk advisory, tax and related services to public and private clients spanning multiple industries. Hamilton Chartered Accountants serves Namibian companies bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges.

This communication contains general information only, and Hamilton Chartered Accountants is by no means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. Hamilton Chartered Accountants shall be responsible for any loss whatsoever sustained by any person who relies on this communication.